Sterling National Bank and Cashfac Announce Strategic Business Alliance for Launch of New Escrow Account Platform

Cashfac is delighted to announce a strategic agreement with Sterling National Bank to expand their Escrow account origination and servicing capabilities.

London, England and Montebello, New York, September 2, 2020 – Today, Cashfac, a global provider of back-office cash management software, and Sterling National Bank (“Sterling”), the wholly-owned operating bank subsidiary of Sterling Bancorp (NYSE: STL), announced a strategic agreement to expand Sterling’s Escrow account origination and servicing capabilities. The partnership will deploy Cashfac’s flagship Virtual Bank Technology (VBT) platform, delivered remotely via the Cloud.

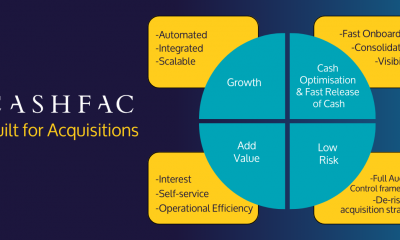

Consistent with Sterling’s strategy of providing high-value, technology-enabled solutions to small and medium-sized businesses, Cashfac’s VBT platform will allow Sterling to provide scalable solutions, enhance client experience through self-service, and utilise automation to reduce resource-intensive tasks for their staff.

Cashfac’s partnership with Sterling will further their efforts toward building a stronger presence and reach in North America and will offer a new set of opportunities for their cash management specialists.

Once implemented, Cashfac VBT will deliver a more streamlined, efficient offering for Sterling’s clients by providing a self-service receivables management process to upload remittance advice, linking its client’s master accounts to many sub-accounts (virtual accounts). These accounts will support interest calculations, provide up-to-date statement information and allow the bank to automate the regulatory checks required for opening new Escrow accounts. Additionally, the platform will remove arduous manual processes currently undertaken by the bank’s team to set up and support the sub-account process, enhance Sterling’s existing client relationships, and offer more tailored solutions to specific market segments, such as Property, Legal and Care Services.

“We are delighted to expand into the Americas in partnership with Sterling National Bank. Their passion for improving customer service levels and providing market-leading solutions excites us,” Richard Cummings, CEO at Cashfac commented. “We look forward to creating valuable offerings and experiences for our clients together.”

“Cashfac provides us with a unique opportunity to leverage a world-renowned contemporary solution in the US to benefit our clients and staff in support of Sterling’s strategy of delivering a superior digital client experience,” Luis Massiani, Sterling National Bank President said. “We greatly appreciate the commitment of the Cashfac team and are eager to begin a successful and lasting relationship with our new partner.”

About Sterling National Bank

Sterling National Bank specialises in the delivery of financial services and solutions for small to mid-size businesses and consumers within the communities we serve through a distinctive team-based delivery approach utilising highly experienced, fully dedicated relationship managers. Sterling National Bank offers a complete line of commercial, business, and consumer banking products and services. For more information, visit www.snb.com.

Find Out More

For more information on how Cashfac can help institutions like Sterling National Bank, please contact the team to discuss your requirements.