For Hassle-Free Client Money Bank Change, Contact Cashfac

This blog explores the benefits and challenges of changing banks for client cash management, focusing on wealth managers, trusts, and non-bank financial intermediaries. It highlights the advantages of bank switching, including risk reduction, better interest rates, cost savings, and improved services, and how the Cashfac multi-bank platform streamlines the transition process.

Introduction

Wealth managers, trusts and trustees, and non-bank financial intermediaries (NBFIs) are institutions that take care to avoid risks to their clients’ wealth in delivering financial services to businesses. They do not have banking licenses, meaning they must rely on banks to hold their client cash deposits.

They may want to switch their client cash management arrangements for day-to-day operational cash. They may search for a bank that offers better interest rates, a more efficient payment process, better intraday visibility of banking operations, and a wider range of treasury services. Sometimes, as trustees, they may be concerned about the direction of the bank, its credit rating, or continued commitment to the level of service they are receiving.

In this paper, we explore some of the benefits and challenges of switching banks for client cash management and how Cashfac can help.

Benefits and Challenges

The process of switching banks can be complex and time-consuming without the right onboarding tools that ensure continuity in client accounting and compliance, minimal disruption, controlled cost, and low impact on existing client relationships, the level of service they can expect from their new bank and the operational complexity of managing two bank relationships for a time until the switchover is complete.

Benefits of switching banks:

- Lower risk to trustees: Credit rating and stability of the bank.

- Improved interest terms: Moving operational cash management to a bank that offers better interest rates can significantly improve the income position of their clients, especially now that high interest rates are so variable between banks.

- Reduced costs: Some banks offer discounts on fees or other financial products in exchange for switching deposits, which can lead to significant cost savings.

- Enhanced service: Some banks offer NBFIs a range of treasury services or a more dedicated account manager, helping NBFIs improve their cash management efficiency.

Bank switching programmes make it easier for customers to switch their bank accounts to a different provider. Programs such as the Bulk Payment Redirection Service (BPRS) offer a cost-effective way to ensure payments continue to be received when a sort code or account number is changed.

The services offered cover Direct Debits, BACS Direct Credits, Faster Payments, and CHAPS (they do not cover all types of payments).

In general, there are two types of bank switching programmes:

- Full bank switching: This is the most comprehensive type of bank switching, allowing a switch of all banking services to a new bank.

- Partial bank switching: This type allows a switch of just some banking services to a new bank. Partial bank switching is simpler and less expensive than full bank switching, although it may not offer the same benefits.

Other options may be available depending on specific needs. For example, some banks may offer the ability to switch banking services on a phased-in basis.

How Cashfac Can Help

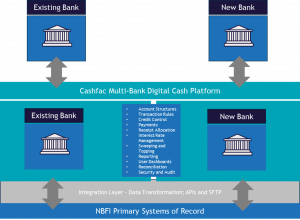

Cashfac offers a multi-bank digital cash platform, allowing the NBFI to connect to one or more banks simultaneously to create a single cash management platform experience across all bank relationships.

Cashfac provides a fully functional connection to the established bank and orchestrates the controlled transfer of processing of payments and receipts while maintaining full accounting, reconciliation, reporting, and treasury management across the old and new account structures at the business, product, and client levels.

The established and proven methodology covers bank accounts and real accounts with continuous credit control and integration with the business’s primary systems of record in a seamless way to drive the following business outcomes:

- Operational efficiency

- Risk control

- Continuous compliance with client money regulations (CASS, RICS, etc.)

- Enhanced interest performance

- Replacement as appropriate of bank accounts with virtual bank accounts

- A platform for growth without investment in additional personnel

- Fast onboarding

- Fast integration of business units and future acquisitions

- Enhanced job satisfaction and better leverage of key person skills

Cashfac’s simultaneous connections with the established and chosen banks through the migration deliver:

- Seamless switchover of client balances – old and new bank accounts are on the same platform.

- Timed switchover of all client balances – Cashfac maintains reconciliation at the client level.

- Easy adoption of pooled banking for optimised treasury approach – Cashfac builds the required virtual account structure under the new bank relationship, ready to receive the cash balances at switchover. A liquidity ladder can be added in the form of notice and fixed-term virtual accounts.

- Easy management of residual balances – any residual transactions still being received to the old bank accounts can also be monitored on the platform with cash balances at the client level and easily transferred to the new bank as required.

- Easy control over a partial or phased migration – Cashfac’s platform will continue to provide a single banking experience across both banks.

Cash Diversification

The Cashfac multi-bank model can be expanded further at the client level by managing cash balances across more than one bank using sweeping and topping. An example is the dynamic and automatic management of the £85,000 FSCS compensation limit for each client.

Summary

Cashfac delivers a complete cash platform service with the highest levels of operational efficiency. It connects to many deposit takers and manages the collections and receipting process with minimum human intervention, keeping operational overheads under budget control. At the same time, it enables an optimised treasury management approach through pooled banking that can be extended to the client level using sweeping and topping methodology across different banks.

Cashfac facilitates bank migration – contact us if you want to change your clients’ bank with the minimum hassle.