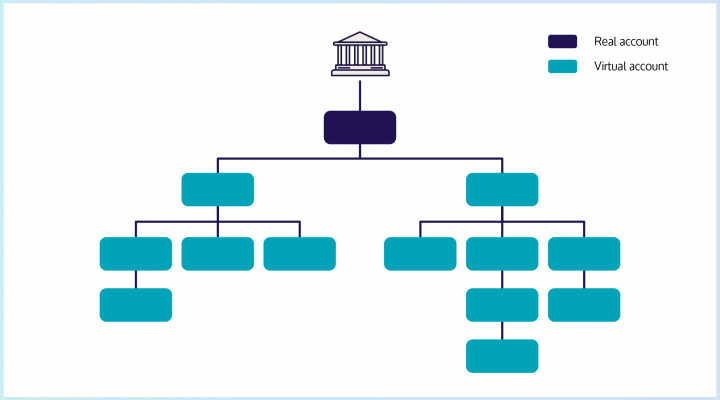

Gain a single view of pooled bank accounts, virtualised into thousands of bank-active virtual accounts

Virtual Account Management (VAM) platforms allow businesses to manage their virtual cash management (VCM) operations more efficiently by providing a single view of their cash and liquidity management, payments and receivables management, in-house banking and client money management. Amongst other benefits crucially, this allows for the reduction of costs and manual processes.

With a VAM solution, businesses can gain a single view of pooled bank accounts that have been virtualised into thousands of bank-active virtual accounts. They are a fully bank active, automated self-service solution made available either on-premise or in the cloud, allowing you to improve and streamline your customer journeys to suit your customer’s requirements.

Cashfac’s broader, more complete Virtual Bank Technology platform harnesses advances in workflow integration, matching, analytics and real-time reporting with functionally rich virtual accounts to provide greater flexibility, customer self-service and a suite of integrated cash management applications.

For more information on our Virtual Account Management capability, please download our full product paper.

Talk to us today

To find out more about how Cashfac's capabilities can help your business, get in touch with our helpful team