Interest Rates: A Brave New World for Consumers and Corporates

Interest rates are the highest they been since the 2000’s. This brings challenges to borrowers but opportunities for those flush with cash – and the right technology to execute.

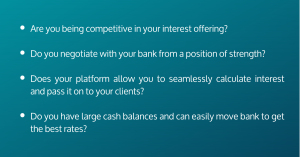

If the answer is no – Cashfac can help you

Cashfac ensures firms make the most of these opportunities:

- Become bank agnostic so you can easily move to the bank offering the best rates

- Generate a new revenue stream that wasn’t available in era of low interest rates

- Use a position of strength to negotiate better terms from your bank

- Offer interest rates to your clients supported by a fully automated platform

- Manage firm and client cash all in one place – across multiple banks

The New Era: 4 Calls to Action

Most firms haven’t experienced an era of high interest rates for decades, and employees under the age of 35 – never! But firms are facing competitors who are already making the most of the opportunities offered by high interest rates – and they are losing customers to the early movers.

High interest rates means higher income for firms who act fast

High interest rates give firms with large amounts of cash the opportunity to generate huge additional income – an opportunity they have not had for decades. In Q2 2022, JP Morgan increased their Net Interest Income by 34% in the prior year. And it’s not just banks who benefit – it’s also firms who manage their own cash and their client’s cash.

The availability of higher interest rates from corporate banks shines a light on how dependent firms are on their current bank

Banks are throwing over themselves to offer higher rates to corporates to win new business. But many firms find it difficult to take advantage of these opportunities because their operating model is tied into their bank processes. Moving to a new bank means considerable upheaval for them and their clients who will not simply jump ship to a new bank. Cashfac empowers firms by making them multi-bank and bank agnostic: they can move bank easily with low operational disruption. And they can be multi-bank – keeping their existing clients happy who don’t want to move bank Either way – the firm with Cashfac operates from a position of strength when dealing with their bank

To offer interest rates to customers firms need seamless automated capabilities – manual solutions are not practical

If firms are going to offer interest income to their customers, to be competitive they need the capabilities to do it. They need to be able to calculate interest payable automatically with seamless booking processes and reconciliations. They need the flexibility to adjust interest by client segment, adopt tiered structures and bonus interest to key clients. All integrated to their existing cash management tools and banks.

Firms need a platform that allows them to manage their cash and their client’s cash in a single place, across all accounts

To make the most of higher interest rates efficiently, firms need an automated platform that sits on top of their operating model and is plugged into all their banks and client accounts. Fragmented, manual processes means higher cost, more manual regulatory controls and lost opportunities.

The New Era – with Cashfac

Cashfac has been helping firms take full advantage of high interest rates for over 20 years. If you want to hear how we can help you – contact us here