Private Equity is changing the landscape of UK PLC through innovation and investment in transformational leadership

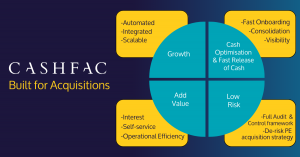

Cashfac is helping Private Equity firms investing in the Pensions, Property and Wealth Management sectors deliver value, fast.

Huge sectors of the UK service industry are being transformed by Private Equity. PE leadership teams are choosing industry sectors that they see as ripe for profitable transformation by applying dynamic leadership and technology transformation.

The chosen sectors are perceived to be sub-optimal in terms of scale and culturally slow to adopt new technologies. Through technology, PE firms can free up and re-deploy acquired cash balances fast. They can de-risk their business strategy by integrating multiple businesses quickly onto a scalable platform. And they can deliver operational efficiencies through standard operating models, applying automation to regulated client money operations.

Why are PE firms looking for digital operational cash solutions to deliver their business strategy?

They need to optimise & release cash quickly in an era of high interest rates

Historically high interest rates have radically increased the benefit of effective cash management and releasing the cash from acquired businesses. PE firms want to consolidate the banking operations of a target business as the first step to consolidating cash balances with their primary bank. They need solutions that enable the rapid and controlled transfer of corporate and client bank account balances from acquired firms.

They want to onboard new acquisitions fast to bring them under control

PE firms want to integrate new acquisitions onto a standard cash operating model quickly, allowing them to move onto the next acquisition knowing they will not face operational bottlenecks. They want to migrate client cash positions fast in a controlled way to minimise business disruption and ensure any control issues are identified and segregated quickly.

The need for scale to compete

The opportunity that PE sees is that many businesses continue to operate with manual and fragmented operating models. These operating models can be standardised through technology. New businesses are then bolted on to standard operating models, releasing huge operational cost savings and delivering better customer service

They want to de-risk payment and regulated client money operations to ensure they focus on value delivery

PE firms are looking to generate value in Wealth, Property Management and Pension Administration. These are all sectors that involve complex, regulated client money operations. PE leadership teams are looking for digital platforms that automate complex cash operations in a single workflow. This reduces risk and people dependency, allowing leadership to focus on delivering acquisition value.

How Cashfac helps deliver this agenda

Cash optimisation through Cashfac’s multi-bank capability

- Cashfac enables corporates to become bank-agnostic – so they can strengthen their negotiating position with their banks to secure the best interest rates and transaction fees

- Acquirers need a solution that transfers bank account and client account balances seamlessly from multiple bank platforms. In the UK this includes iSite and GEM+ (Lloyds), CMS (NatWest), CMM (HSBC) and BMAP (Barclays)

- Cashfac’s cash migration tools enable acquiring entities to absorb the incumbent banking operations as a first step to consolidation with the primary relationship bank

- In a regulated client money businesses this is complex, requiring full segregation of client money along with, for example, service charge monies in Property Management. Automated reconciliations are required to isolate historical problems

Cashfac’s onboarding toolkit ensures acquirers can onboard new acquisitions fast to standardise the operating model and bring them under control

- Cashfac has a proven toolkit for onboarding. The toolkit includes high volume client account transfers with reconciled balances and account histories.

- Embedded transitional rules are used to adopt the acquisition target’s operations before normalisation

- The platform provides an audit trail, including acquired out-of-rec positions

- It provides traceability and audit trail in the migration process. This can be used to support acquisition purchase price adjustments

Cashfac’s embedded automation capabilities and workflow bring scale to acquired entities

- Cashfac automates all complex cash management operations in a transparent workflow that highlights exceptions, provides authorisation queues, connects with banks and reconciles overnight before commencement of operations

- Cashfac’s AORD system automatically monitors the progress of key overnight, intraday and bank connection, high volume cash processing operations and alerts in real time to bring management attention to problem solving in place of manually intensive investigation

- Cashfac VBT is horizontally and vertically scalable. It includes containerisation, Rest APIs and load balancing. It operates at multiple Azure sites in Europe, the US and APAC, with option to migrate to AWS). It uses current globally tested SQL and MongoDB

Cashfac’s embedded controls and automation de-risks payment and regulated money operations

- Sectors that are highly regulated for client money require high levels of automation to ensure regulatory compliance and effective operational risk management

- Cashfac is the only platform that has payment capabilities with automated continuous reconciliations and double entry accounting for corporate and client accounting

- Embedded payments are connected to these accounting controls ensuring that the payment flow is fully integrated with reconciliation and accounting generation: Cashfac provides order to payment traceability

Get in Touch

If you want to hear how we can help you – contact us here