Transforming Your Deposit Strategy: Three Approaches Every Bank Must Consider

Competition for deposits has increased dramatically.

Higher interest rates, shifting client expectations, and the rapid pace of innovation are forcing banks to rethink how they attract and retain clients. Relying on legacy systems or competing rates is no longer sustainable.

To succeed, banks need smarter, more strategic approaches.

Our team has identified three ways banks are driving deposit growth while strengthening client relationships:

1.Strong & Specialized Leadership

Today’s deposit leaders bring a unique mix of skills. They are industry specialists with a deep understanding of client needs, and they are also product and technology experts who know how to deliver innovation.

On the client side, these leaders understand user journeys, pain points, and service gaps across the industries they serve. For example, a leader with expertise in the Homeowner Association (HOA) sector knows that clients need account hierarchies that align to their business, specialized reporting, efficient payment flows, and easy account management. With that insight, they can design solutions that resonate far more than a generic, one-size-fits-all approach.

At the same time, these leaders typically come from larger banks where they’ve gained hands-on experience with advanced digital banking products. They know which capabilities the market demands, and they bring the know-how to accelerate product deployment and organizational change. In practice, this means mid-tier institutions can enter the market faster, equipped with tools that drive deposit growth and strengthen client relationships.

At Cashfac, our platform is configurable across 16+ industry verticals from HOAs and healthcare to legal, property, and insurance – enabling these leaders to combine industry insight with technical capabilities.

This combination of specialization and innovation is what allows banks to compete effectively with the top tier.

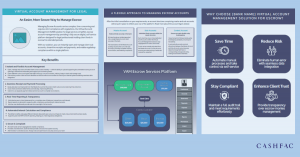

2. Virtual Account Management: Essential for Competing with Larger Banks

According to Datos, VAM is no longer optional – it’s imperative.

These solutions modernize legacy systems, provide scalability, and enable banks to serve industries with complex account structures. They also open the door to embedded banking models and integrated digital services that today’s clients increasingly expect.

VAM empowers banks to:

- Launch new deposit products quickly

- Serve specialized industries with scale and precision

- Improve satisfaction through self-service and real-time capabilities

Cashfac strengthens this even further with:

- Self-service PowerBI dashboards: easy-to-build reporting without specialist licences

- Real-time APIs and event streaming: instant balance, payment, and account updates

- Sector-specific reporting: regulatory or industry-tailored insights

- Seamless client migration: new VAM client onboarding typically completed within 2 hours

While escrow remains one of the most common applications of VAM, leading banks are going further, using it to unlock new markets and deliver stronger client experiences across a range of sectors.

One example comes from a client who initially deployed Cashfac to support its escrow business. Soon after, a healthcare insurer managing thousands of physical accounts sought a better solution. Using Cashfac, the bank migrated the insurer overnight, replacing thousands of accounts with a single physical account and a virtual account layer. The result was full automation of account opening, payments, and allocations, eliminating manual processes and enabling the bank to enter a new, high-value vertical.

The most successful banks aren’t winning deposits by outbidding competitors on rates.

They’re winning by offering superior functionality, faster onboarding, and client experiences that fintechs and larger institutions struggle to match.

3. Vendor Partnerships that Drive Lasting Success

Technology alone doesn’t transform deposit strategies. Banks that achieve the strongest results view their vendor as a growth partner, not just a provider.

At Cashfac, this partnership takes several forms:

- Go-to-Market Collaboration: We work side by side with our clients on rollout sales strategies, product positioning, and marketing collateral, and supporting prospect demos. From industry-specific use cases to sales enablement, we ensure banks translate their technology investments into measurable growth.

- Continuous Enhancement: We reinvest around 20% of our annual revenue into product development, ensuring our solution evolves in line with market, regulatory, and customer demands.

- Client Advisory Group: We bring banks together to share insights, shape our roadmap, and learn from one another. This collaboration keeps us aligned with the real needs of deposit-focused institutions

This ongoing collaboration ensures banks not only implement VAM successfully, but also maximize its long-term impact on deposit generation and client retention.

The race for deposits will only intensify. The institutions that win will be those that combine three essential strategies: hiring specialized leaders, deploying powerful VAM solutions, and partnering with vendors who deliver continuous value.

At Cashfac, we help banks bring these elements together, empowering them to deepen client relationships, unlock new markets, and compete effectively with the largest institutions.