How to become the “Umbrella Bank”

Cashfac experts Ray Wilson and James McGivern explain how banks can place themselves at the heart of their corporate customers’ global banking by becoming their ‘Umbrella Bank’.

Virtual Bank Accounts have become one of the key products in the arsenal of any aspirational corporate bank offering cash management services. This is evident in both mainstream banks as well as the many challenger banks keen to offer disruptive technology. Virtual Accounts allow banks to extend their core Demand Deposit Account (DDA) platform by allowing their clients to create virtual accounts linked to one or more pooled bank accounts at the bank. A typical client for this service would be any organisation that has complex or large-scale receivables processing or an organisation that is required to segregate funds within a pooled account for legal or regulatory purposes. These solutions have existed for some time and offer a single bank connection linked to the underlying DDA accounts within the offering bank’s infrastructure.

However, almost all large corporate clients and an increasing number of mid-size corporates operate multiple bank relationships across multiple currencies. This may be due to their geographical operational requirements, network limitations of their bankers, risk and governance, or part of a wider corporate strategy. Also, clients of the bank who themselves offer sophisticated financial products have an even greater need for multi-currency virtual accounts across the globe. This leaves individual banks settling for a smaller slice of their client’s potential business, however strong their corporate relationships may be.

Becoming the ‘Umbrella Bank’

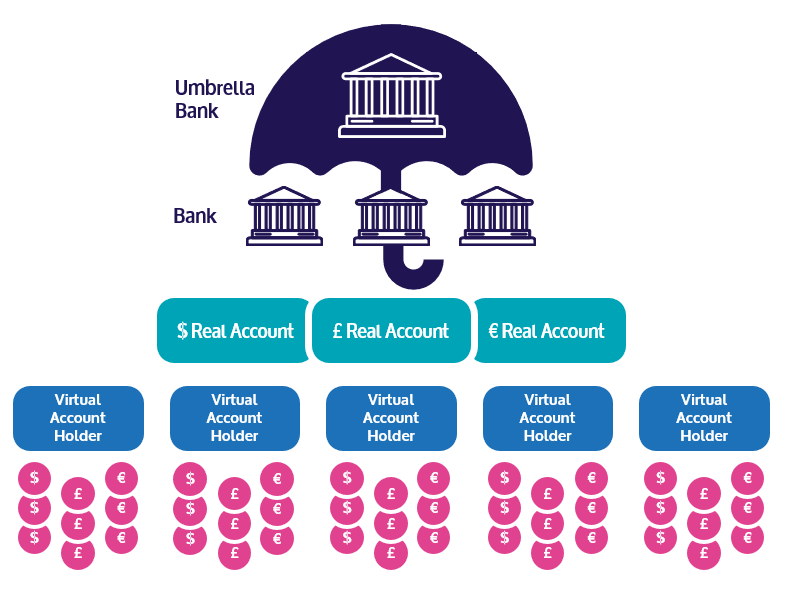

The latest generation of Cashfac Virtual Bank Technology (VBT) allows any bank to become the “Umbrella Bank” to their corporate customers. It is a single platform that places the bank at the heart of their customers’ global banking by providing a white-labelled, bank-branded, multi-bank, multi-currency virtual account platform. This new bank-provided platform is able to extend the natural capability of each bank into a wider network of banks to meet the specific needs of each corporate. All banks within the Umbrella Bank are controlled and given access at the discretion and control of the Umbrella Bank. This allows the bank to provide a comprehensive and fully integrated corporate virtual account solution.

Typical multi-bank virtual account model

Advantages to the Bank

Our virtual account umbrella bank platform allows any bank to offer a fully integrated multi-bank and multi-currency platform to its corporate clients. This enables the bank to form a genuine strategic partnership with their corporate clients, allowing them to capture more of each client’s business and establish stronger, long-lasting relationships with their customers. Most importantly, this will also allow the bank to operate on a higher tier, competing with global banks without the costs associated with a global footprint.

The key business driver for the corporate customer (and therefore the providing bank) is state of the art ERP connectivity. This is achieved through a comprehensive API suite that drives all major system functions. This direct connectivity enables their corporate customer to upload all current and future-dated cash movements as well as automating all required ERP inter-operation. This brings huge benefits to their client (see below). When combined with the analytical tools on the virtual account platform, this allows detailed analysis of all client transaction flows and cash holdings at all banks, even if the data is only available at a meta level. This enables the lead Umbrella Bank to get a deep understanding of the client’s business and thus refine its product offering more effectively to the client’s requirements globally.

Multi-bank connectivity allows a bank to compete when their customer has requirements outside of the bank’s current geographical reach. This is a truly disruptive technology. Cashfac VBT’s full service multi-bank, multi-currency virtual account solution offers a range of functionality to help you control and process these more complex transactions flows in an efficient and compliant manner. Importantly, our platform automatically manages the accounting and settlement of foreign exchange trades and the sweeping of funds across the client’s multi-bank ecosystem, enhancing the management of liquidity and controlling risk.

Advantages for the Bank’s Corporate Clients

Our virtual account umbrella bank platform integrates the many banking services required by a corporate into one consistent integrated and cost-effective platform.

“You can’t manage what you can’t see”. Customisable access, views, and controls can be fully standardised across the group, therefore reducing risk and providing greater transparency. With near real-time statement updates, there is no need for the client to wait for reporting or to maintain intra updates on spreadsheets. They can review the actual cash and see the virtual banking platform’s cash flow forecasts for as far forward as their business requires.

Bank account access controls and authorisation paths can be configured to follow internal governance across the group. This includes real bank accounts and virtual bank accounts, offering greater control.

A full suite of customer APIs enables all key product features to be seamlessly linked to customer ERP and accounting systems through one standardised statement/file format for all accounts. This is further enhanced by the ability to load future-dated payments and receipts from business ERP systems into the global virtual account framework to aid projections, manage settlement and deliver credit control. Virtual accounts that have integrated general ledgers now work actively to ensure accounting of cash is seamless. This enhances visibility and control across the entire group irrespective of the bank.

This new multi-bank capability removes redundant proprietary UI’s from other banks, removing the need to maintain user controls across multiple systems, creating a centralised in-house banking platform. Dashboards enable simplified role-based access, with KPIs to easily manage and navigate this global banking framework.

Treasury can standardise its approach and enforce their policy across the group effectively now that they have all pooled funds across all currencies in one system. Treasury transactions can be accounted for, controlled and settled on the virtual account platform, giving them complete control through the settlement cycle.

Become your clients’ Umbrella Bank

For more information on how Cashfac VBT can help you become the ‘Umbrella Bank’ to your corporate clients, please get in touch using the form below.