IOLTAs and IOLAs

Why is this important for banks?

IOLTAS and IOLAs help boost a bank’s reputation and attract new customers to their doors. The obvious customers drawn to an IOLTA/IOLA bearing bank are attorneys, who will need these accounts for their clients, but will also bring corporate and trust accounts with them. However, the awards and recognition earned for helping to support the charitable causes that benefit from the IOLTA program can bolster a bank’s reputation and attract ethically minded corporations and individuals.

What are IOLAs/IOLTAs?

Attorneys routinely receive funds from clients to hold in trust for future use. When these funds are small in size or held for a short period of time, they are pooled into a single, interest-bearing trust account called an IOLTA (Interest on Lawyer Trust Account). The purpose of an IOLTA is to generate interest on the funds held for a client so it can be remitted to the state IOLTA program, which uses the income for charitable purposes such civil legal services and legal aid for low-income residents. IOLTAs are carefully regulated by the state bar association and it is incumbent on law firms to show these funds are correctly managed with double-entry accounting and audit trails.

IOLTAs and IOLAs are the same types of account, but with different names. All states use the IOLTA name, except for New York, which has its own naming scheme called IOLA (Interest on Lawyer Account).

How do IOLTAs work in Cashfac?

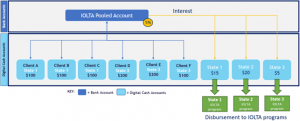

Cashfac enables attorneys to logically separate the pooled client funds in their IOLTA account with self-service digital cash accounts. It takes 2 minutes to create a new digital cash account for a client, where their funds can be allocated from the pooled IOLTA account.

Interest is accrued daily for each client and capitalised monthly into a separate digital cash account specific to each state. This provides a clear view of the interest generated for each state across the portfolio of clients. The funds from the state accounts are automatically disbursed to the respective IOLTA associations according to a specified schedule.

When the money needs to be returned to a client it can be paid directly to their personal bank account from the digital cash account using a Wire, ACH or check. This same method can be used to draw down a retainer for legal services after they have been provided.

Attorney Benefits

IOLTAs may seem simple, but maintaining a compliant IOLTA can be very complex and time-consuming for law firms, whilst charging clients for that time is an ethical minefield. All Cashfac digital cash accounts are underpinned by a ledger with automatic reconciliations, so whenever a payment is made or transferred between accounts, you can be sure the ledger is updated automatically and accurately.

Out-of-the-box reports and full audit trails of all user actions are available to download in seconds, so attorney’s no longer need to worry about the record keeping and compliance side of IOLTAs. Cashfac simplifies IOLTAs through:

- Automation of compliance

- Control of client money movements

- Visibility of all balances and transactions at a client and state level

- Transparency to the client and the auditor

Get in touch to find out more.